Listen in podcast app and follow below for the podcast topic arc.

Market update

Canadian inflation

The Bond opportunity

Warrens Big Miss with Disney Stock

F1 meets the PGA?

Recommendations and Links

Listen on Apple, Spotify, or Google Podcasts.

Market Update📈📉

Welcome back Listeners and Readers

Quick take on Canadian Inflation Data:

Canada's annual inflation rate eased to 3.8 per cent in September, reflecting a slowdown in price increases compared to the previous month, when it peaked at 4 per cent. While certain categories, such as airfare and durable goods, saw price decreases, grocery prices remained elevated. Alberta's inflation rate for September was 3.7 per cent, similar to the national average

Some Thoughts on Bonds from the internet:

"this is the biggest bond market rout in 150 years. Last year was worst year since 1871, with a total return of minus 15.7%, even worse than the annus horribilis of 2009. We are looking at bond investors’ two worst years in a century and a half.”

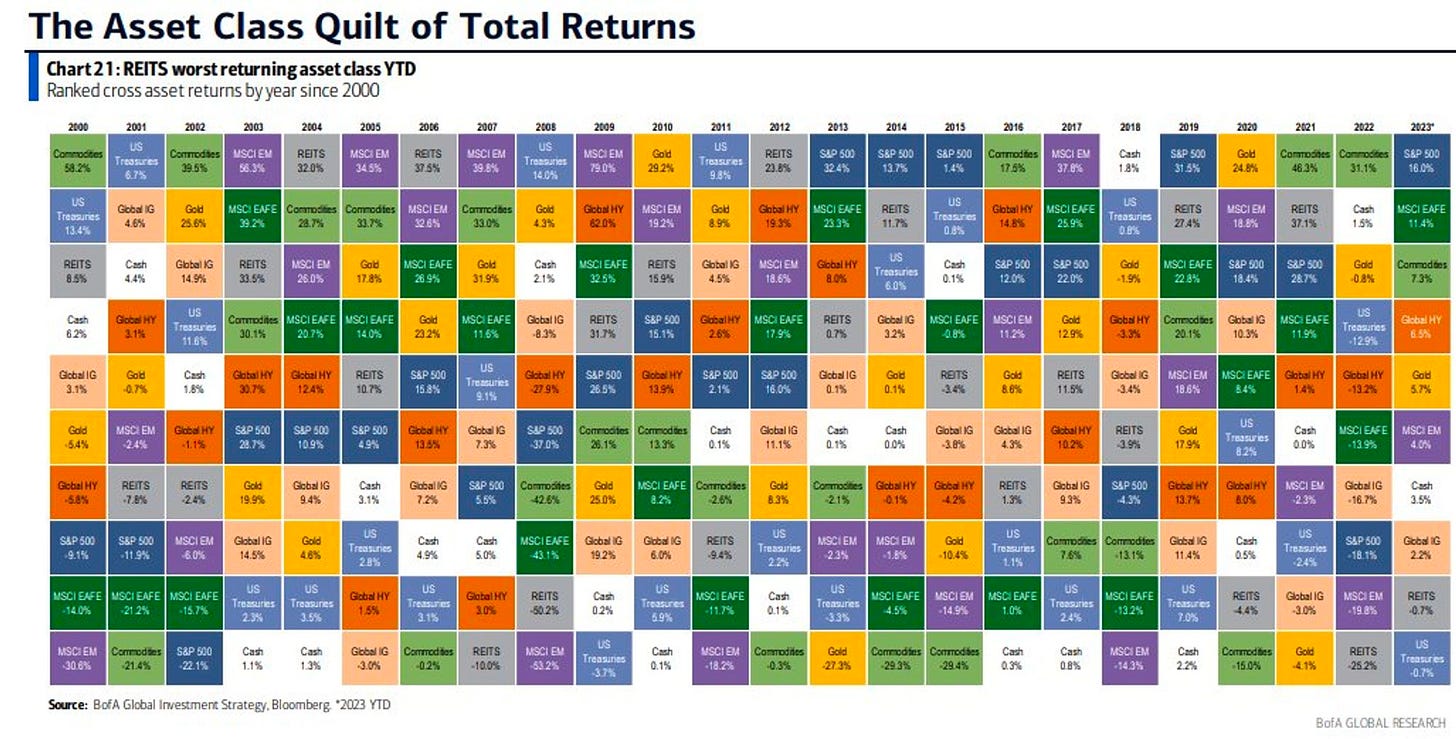

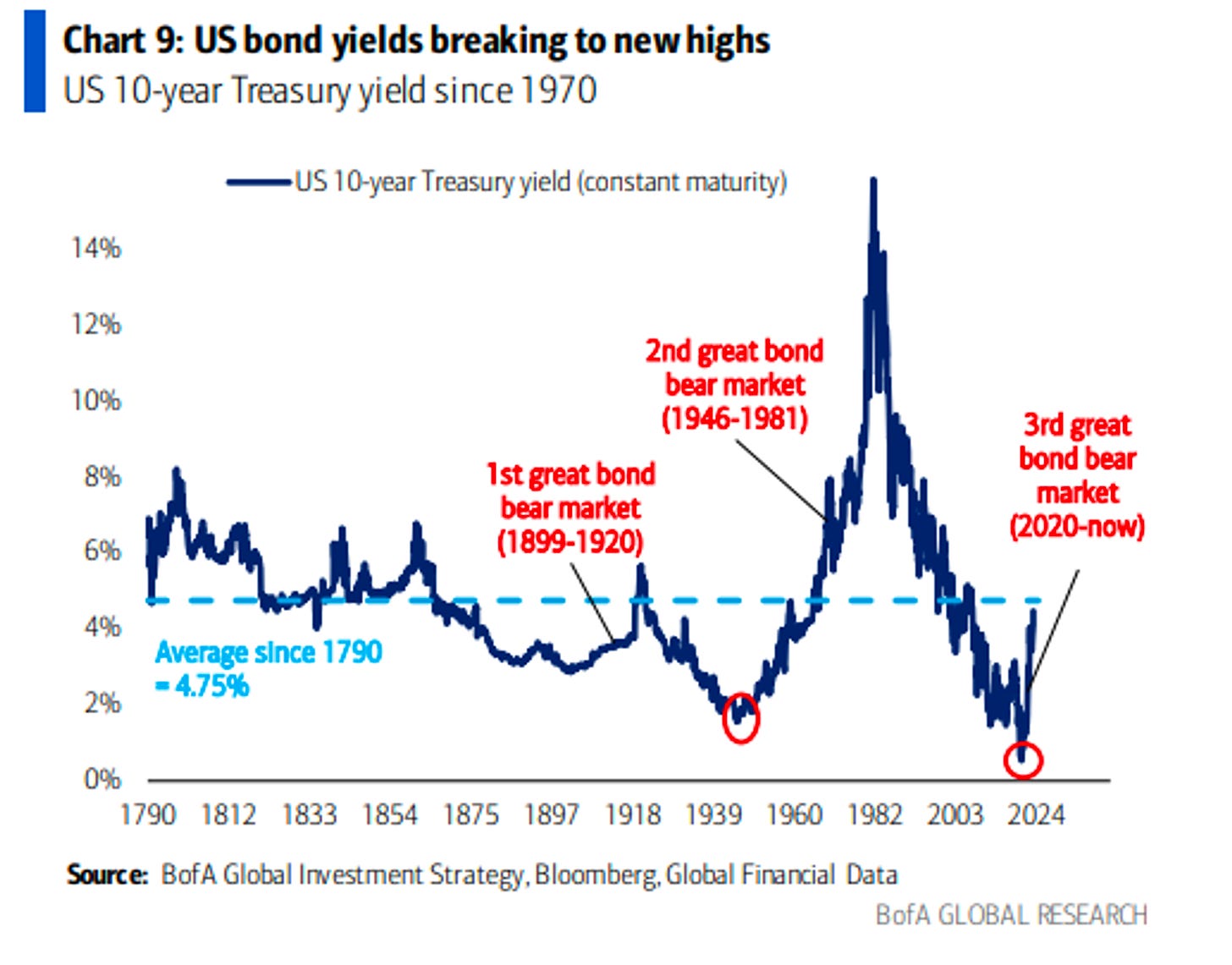

Quilt chart above and US bond yield chart below from BofA Global Investment strategy:

New highs:

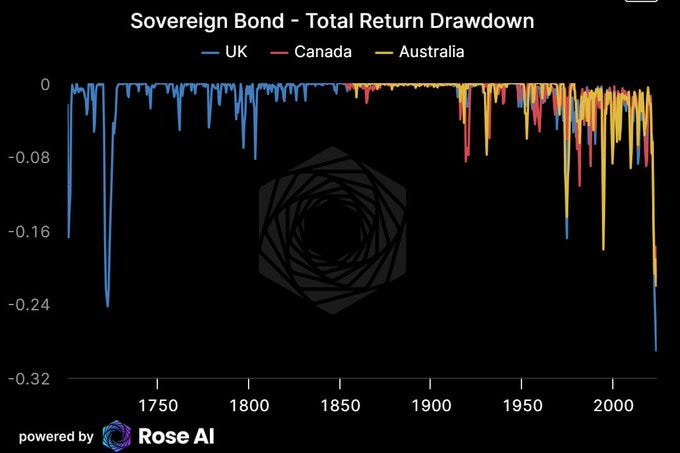

Great charts and thread from Bob Elliott - my favorite from the link:

One of the largest bond routes in history.

To put this US selloff into a broader perspective highlights that the ~30% drop in US bonds is on par with the largest historical declines in the UK.

Twitter links from the pod:

Trevor Tombe details the Canadian Inflation print from Oct 17th

Fabricated Knowledge compares the AI buildout to the telecom buildout

Trung Phan talks about Warrens Buffets BIGGEST miss - DIS stock

Podcast & YouTube Recommendations🎙

I loved this Theo and Harris Conversation about the business of Youtube Watch Content:

Scott Galloway gives great personal finance advice:

Affordable housing clip: Boomer vs. Gen Z

Best Links of The Week🔮

Marc Andreesen is out with The Techno-Optimist Manifesto - here

"Interest rates are high, inflation remains elevated and pandemic savings are dwindling. Yet the U.S. consumer is on a spending binge. The display of consumer resilience persisted in the latest retail-sales report, which on Tuesday showed spending at stores, online and at restaurants rose a stronger-than-expected 0.7% in September from a month earlier... Consumers are still splashing out on a range of items and experiences, including on interest-rate-sensitive cars and more expensive restaurant meals." Source: WSJ

"General Motors’ driverless-car unit Cruise is confronting a new safety investigation by federal regulators, after reports of its autonomous vehicles exhibiting risky behavior around pedestrians. The National Highway Traffic Safety Administration said in a Tuesday filing that it had opened a safety-defect probe into nearly 600 driverless cars operated by Cruise, adding that they might not be exercising appropriate caution in crosswalks and roadways... The probe represents the latest challenge for the San-Francisco-based Cruise, which is majority owned by GM, as the driverless-car firm tries to expand services in the Bay Area, Austin, Texas and Phoenix." Source: WSJ

"Disney reorganized its company into three segments earlier this year, splitting ESPN and sports apart from its entertainment division. As part of the split, investors are now getting a look under the hood at ESPN. ESPN generated more than $12.5 billion in revenue for the nine months ending July 1." Source: CNBC

"OpenAI is in talks to sell existing employees’ shares at an $86 billion valuation... The artificial intelligence startup behind ChatGPT is negotiating the transaction, known as a tender offer, with potential investors." Source: Bloomberg

Disclaimer:

Investing in equities, fixed-income instruments and/or alternative asset classes involves substantial risk of loss. Any action you may take as a result of the information presented on this website, blog or in any Reformed Millennials Podcast (a “podcast”) is your own responsibility. By opening this page and/or listening to a podcast, you accept and agree to the terms of this full legal disclaimer. The information on this website, blog and in any podcast is presented as a general educational, informational and entertainment resource only. While Joel Shackleton is registered to provide investment advice in Saskatchewan, Alberta, British Columbia and Ontario as an Advising Representative this website, blog and any podcast does not provide, and should not be construed as providing, individualized investment, tax or insurance advice, nor as containing any recommendation to buy or sell any specific securities or otherwise make any other form of investment, or take any tax or insurance decision. Nothing contained on this website, blog or in any podcast should be construed or interpreted by you to mean that an investment in any securities presented or discussed would be suitable for you in your particular circumstances. Joel Shackleton and Cameron Pitchers specifically disclaim that any viewer of this website, blog or any podcast should rely in any way on any of their contents as investment, tax or insurance advice or as an investment, insurance or tax recommendation. Viewers are encouraged to consult with their individual investment advisor and other financial professionals prior to taking any potential investment actions or making any insurance or tax decisions. The views and opinions expressed herein are the personal views and opinions of Joel Shackleton, Cameron Pitchers and any other specific contributor to the blog or podcast only and do not necessarily reflect the views or opinions of their Firm or any of its other registered individuals or employees in partnership with Joel and his guests. Joel Shackleton and Cameron Pitchers disclaims any obligation to update any of the information set out on this website or any blog or podcast going-forward

Share this post