Listen in podcast app and follow below for the podcast topic arc.

Ohtani Contract

Liv Golf

Jerome Powell FOMC meeting recap

Market Update

Canadian Mortgages

Recommendations and Links

Listen on Apple, Spotify, or Google Podcasts.

Market Update📈📉

Some thoughts…

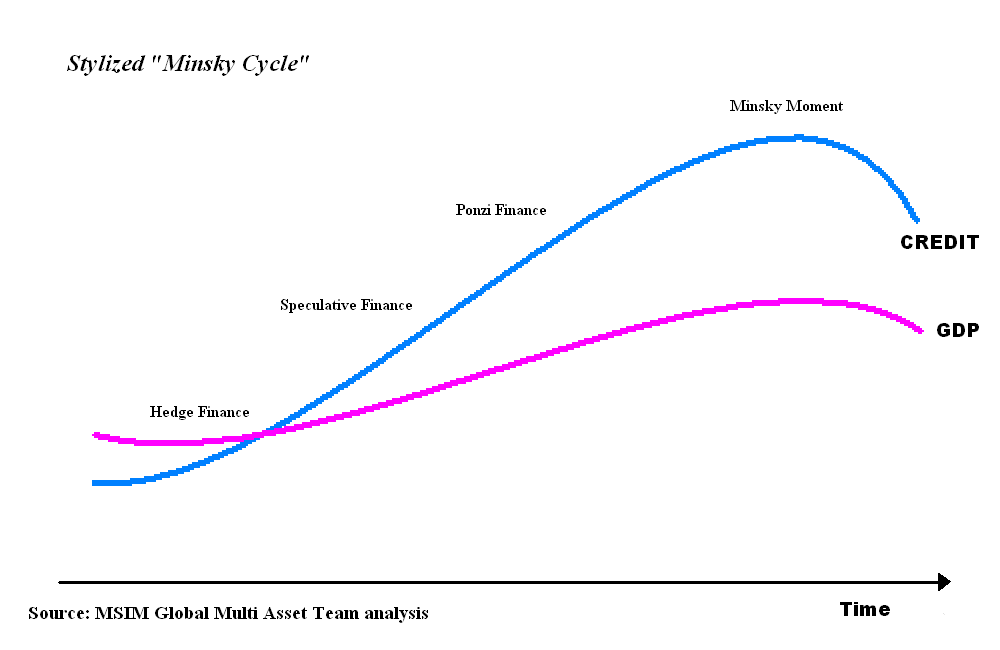

Markets are inherently pro cyclical. Liquidity attracts liquidity. Momentum attracts momentum. Sentiment is contagious. The best summary of this is the Minsky Hypothesis.

Minsky had three phases:

Cash Flow Investing Phase: Investors initially focus on investments based on cash flows and fundamental values, driving steady market growth.

The focus is yield and downside minimization

Speculative Phase: Gradually, as markets rise and confidence grows, investors shift towards speculative investments, often relying on debt, disregarding underlying values.

The focus is capital gains and trends

Ponzi Finance Phase: The market reaches a point where investments are made with the expectation that prices will continue to rise, ignoring fundamentals.

The focus is ‘past returns = future returns’ so buy more

This unsustainable growth leads to a market correction when the reality of overvaluation and excessive debt becomes apparent.

Minsky’s framework explains both the 2008 crisis and 2022 crypto leverage crash. It’s a great framework…

Twitter links from the pod:

This guy created the world's 1st ever, fully transparent fashion brand.

My relatives immigrated from Bangladesh to Reno, Nevada just 6 months ago.

Podcast & YouTube Recommendations🎙

Optimistic Science Fiction - Foundry

TCAF with my favorite guest, Bob Elliott:

Cultivating Happiness with Peter Attia:

Best Links of The Week🔮

"Big tech stocks reclaimed their position as the market’s leaders this year. Just how far ahead of the pack have they run? Collectively, the stocks known as the Magnificent Seven—Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta—have jumped 75% in 2023, leaving the other 493 companies in the S&P 500 in their dust. (Those have risen a more modest 12%, while the index as a whole is up 23%.)" Source: WSJ

"For LVMH and other luxury-goods stocks, 2024 is shaping up to be 2023 in reverse. Unlike this year, when China’s reopening fueled a splurge on pricey handbags and jewelry before running out of steam, investors expect 2024 to start on a weak footing before a revival in the second half. As analysts at BNP Paribas put it, next year will likely be “a game of two halves” for luxury stocks such as Richemont and Gucci-owner Kering." Source: Bloomberg

"The mounting deluge of mostly irrelevant information is overwhelming many investors, making financial markets more chaotic and less efficient at pricing in important data, says hedge fund magnate Clifford Asness. The founder of US-based AQR Capital Management, still one of the world’s biggest computer-driven investment firms despite a sharp drop in assets in recent years, once studied under the University of Chicago’s Eugene Fama, who won a Nobel Prize for his efficient markets hypothesis. But three decades of exposure to how markets work has eroded Asness’s belief in the theory." Source: FT

"Next year is shaping up to be another pivotal year for weight loss drugs, which skyrocketed in popularity despite hefty price tags, mixed insurance coverage and some unpleasant side effects. Investors will be watching to see how Eli Lilly and Novo Nordisk navigate the ongoing supply issues plaguing their treatments. Those two companies and other drugmakers hoping to join the weight loss drug market are also expected to release crucial clinical trial data." Source: CNBC

"Confronting sizable debt burdens and the fact that most streaming services still don’t make money, studios like Disney and Warner Bros. Discovery have begun to soften their do-not-sell-to-[NFLX] stances. The companies are still holding back their most popular content — movies from the Disney-owned Star Wars and Marvel universes and blockbuster original series like HBO’s “Game of Thrones” aren’t going anywhere — but dozens of other films like “Dune” and “Prometheus” and series like “Young Sheldon” are being sent to the streaming behemoth in return for much-needed cash. And [NFLX] is once again benefiting." Source: NYT

Disclaimer:

Investing in equities, fixed-income instruments and/or alternative asset classes involves substantial risk of loss. Any action you may take as a result of the information presented on this website, blog or in any Reformed Millennials Podcast (a “podcast”) is your own responsibility. By opening this page and/or listening to a podcast, you accept and agree to the terms of this full legal disclaimer. The information on this website, blog and in any podcast is presented as a general educational, informational and entertainment resource only. While Joel Shackleton is registered to provide investment advice as an Advising Representative this website, blog and any podcast does not provide, and should not be construed as providing, individualized investment, tax or insurance advice, nor as containing any recommendation to buy or sell any specific securities or otherwise make any other form of investment, or take any tax or insurance decision. Nothing contained on this website, blog or in any podcast should be construed or interpreted by you to mean that an investment in any securities presented or discussed would be suitable for you in your particular circumstances. Joel Shackleton specifically disclaim that any viewer of this website, blog or any podcast should rely in any way on any of their contents as investment, tax or insurance advice or as an investment, insurance or tax recommendation. Viewers are encouraged to consult with their individual investment advisor and other financial professionals prior to taking any potential investment actions or making any insurance or tax decisions. The views and opinions expressed herein are the personal views and opinions of Joel Shackleton and any other specific contributor to the blog or podcast only and do not necessarily reflect the views or opinions of their Firm or any of its other registered individuals or employees in partnership with Joel and his guests. Joel Shackleton disclaims any obligation to update any of the information set out on this website or any blog or podcast going-forward.

Share this post