In this week's Founder Series episode of Reformed Millennials, Joel Interviews ESG Analytics CEO Qayyum “Q” Rajan, CFA.

Q isn’t just a data scientist shining a light on ESG, he’s also co-founder of iComplyis and one of the most forward-thinking people we’ve spoken to in Canadian Tech.

ESG Analytics is a web-based solution and API that uses broad-based alternative data sources and artificial intelligence (AI) to uncover risks and opportunities in the environmental, social, and governance (ESG) practices of countries, companies, and ETFs. ESG Analytics's continuously updating big data platform allows researchers, analysts, funds, and companies to get new and timely insights as they integrate ESG as part of the investment management process and company decision making.

Listen on Apple, Spotify, or Google Podcasts.

If you aren’t in the Reformed Millennials Facebook Group join us for daily updates, discussions, and deep dives into the investable trends Millennials should be paying attention to.

👉 For specific investment questions or advice contact Joel @ Gold Investment Management.

Big Idea:

Empowering investors to find the Intersection of truth and ESG investing.

Environmental. Social. Governance

At Reformed Millennials we’ve bounced back and forth with the idea of investing in this space. And as fiduciaries, there is a fine line you have to walk when taking into consideration what’s best for your client and what’s best for the world.

ESG Analytics allows you to make educated and informed decisions around your portfolio construction.

And if you’ve been paying any attention at all, ESG has whipped the floor with all other factor strategies since 2018. There is clearly alpha in this burgeoning trend.

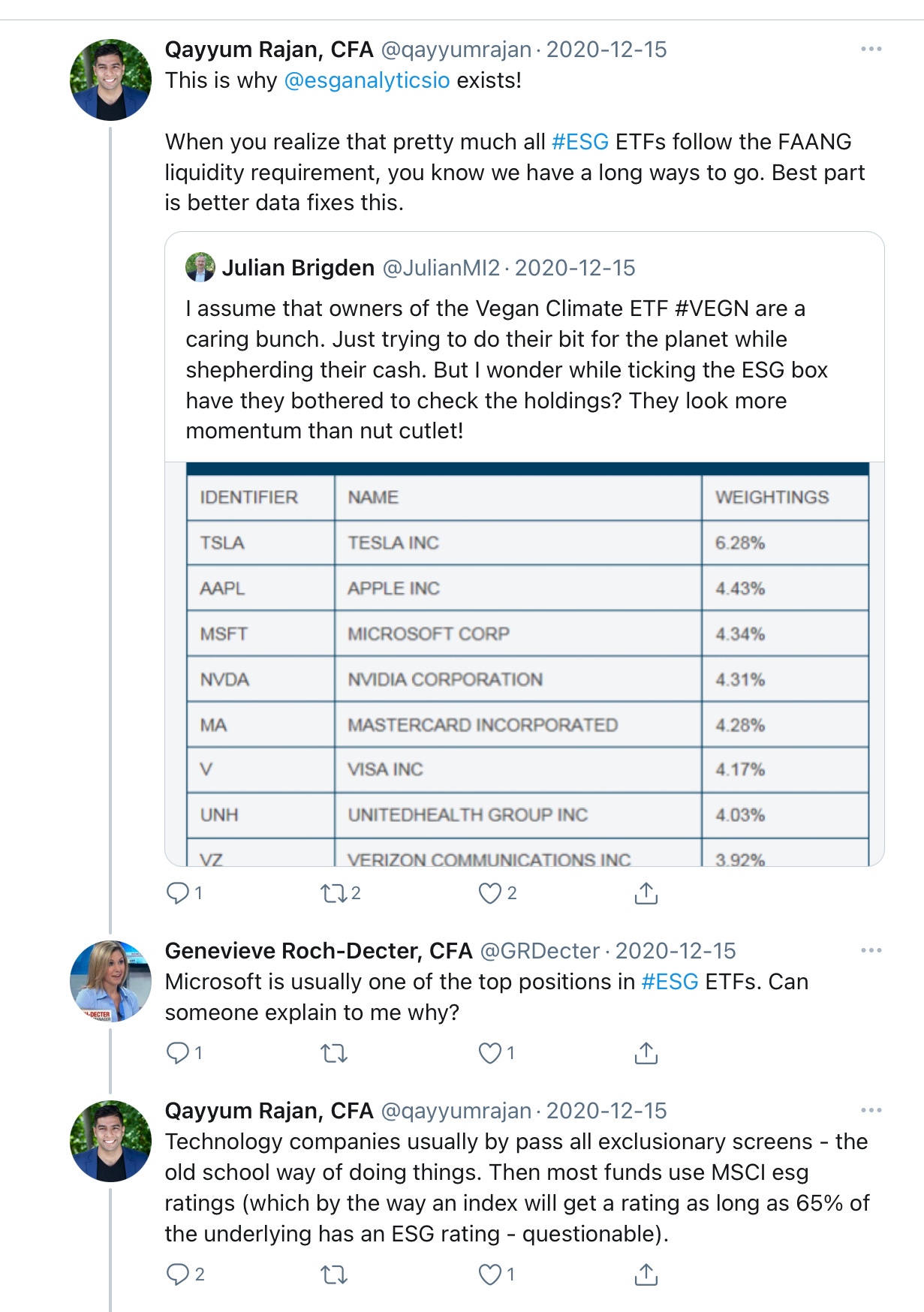

Why ESG Analytics Exists:

From the Financial Times:

The environment for ESG could not be at a bigger transition time in history. We are at the crossroads of 3 major trends – ESG, AI and Alternative Data. Providers of ESG data today continue to have abysmal coverage of the investable universe, with most covering less than 10,000 companies. This is further impacted by slow or delayed analysis, outdated data sources, low-quality self assessed data and inherent biases, all of which impact investor decision making negatively. We believe investors need to look at the problem differently; it’s not enough to say that a company is ESG because it is in a certain industry, or that a fund is sustainable because it has ESG in its name. .

ESG Analytics AI-driven approach allows for users of the software to:

Compare and contrast 80+ ESG indicators for over 193 countries

Analyze negative and positive screens for companies globally

Use AI to sift through the universe of unstructured media to determine potential ESG risks and opportunities for over 60,000 companies across 22 different stock exchanges

Aggregate and view screens and AI flags for 1200 ETFs globally

Mentioned Content🧐

Books:

Articles:

If you want to learn more about Q check him out here

All information provided is for educational purposes only and does not constitute investment, legal or tax advice, or an offer to buy or sell any security. For our full disclosures and disclaimer, visit our website: https://gold-im.com/disclaimer/

Share this post