Managing money through the lifecycles of clients which we have to then overlay over the complexities of geopolitics which is then overlayed on top of market cycles and technology cycles makes for an interesting job.

Advising enterprising families and clients is complex. But the next 10 years are going to be a blast.

Why do I say that?

Well, Michael Parekh recently wrote a piece drawing similarities between our last technological revolution and todays Ai revolution.

Watching companies like META, GOOG, AAPL, NVDA, MSFT, TSLA and AMZN grow and evolve has been an absolute treat.

Picking the next big 7 is going to be just as fun.

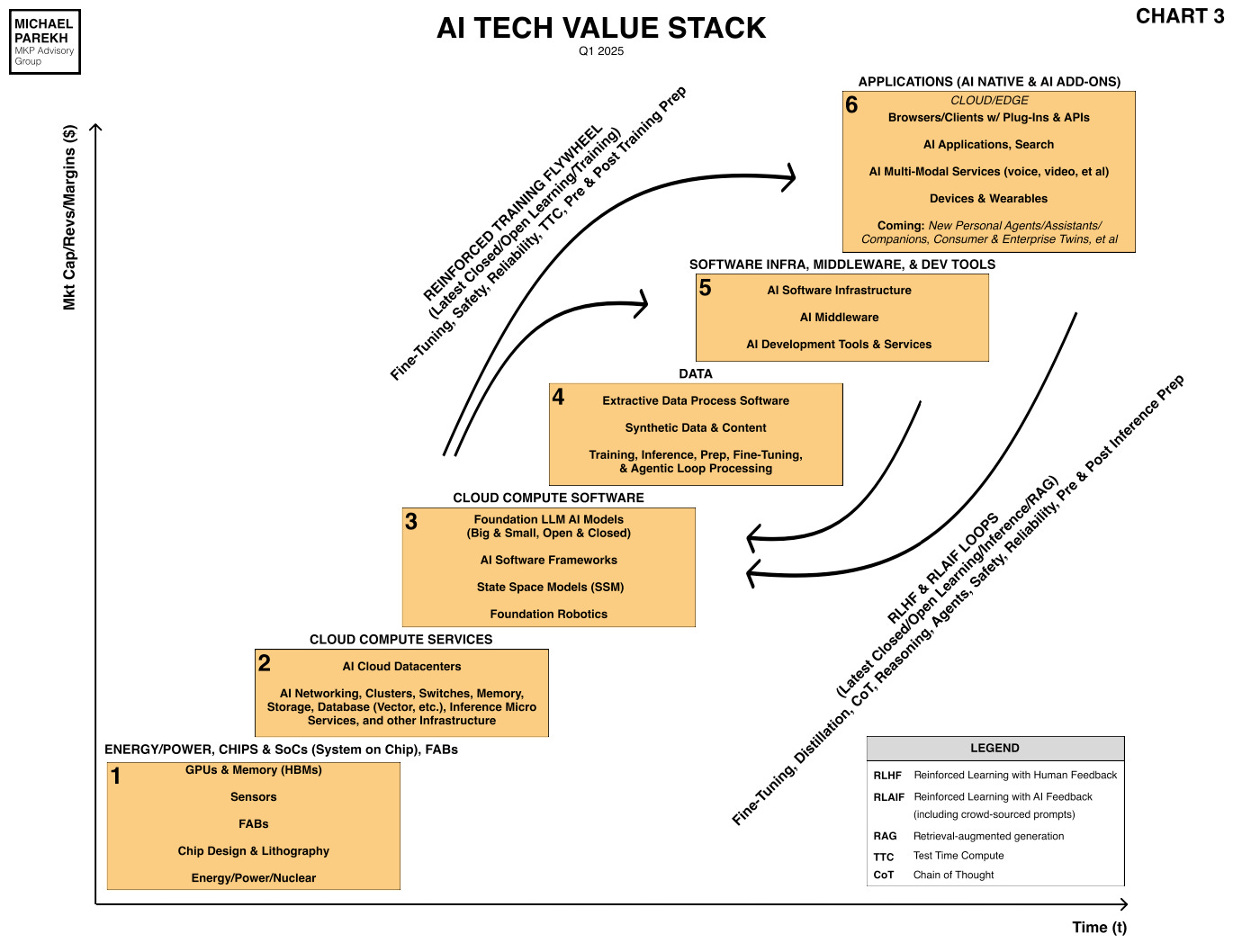

Over the last thirty plus years, each major technology wave, like the PC and then the Internet, evolved as a series of technologies in a tech value stack that came to define the technology ecosystem with huge collective value over time.

The above 6 box tech stack is the image I draw on whenever I need to think about where an investment opportunity lies with regards to profitability, timeline and competition.

Thinking through our last technology cycles gives us insight into tomorrow and beyond.

How?

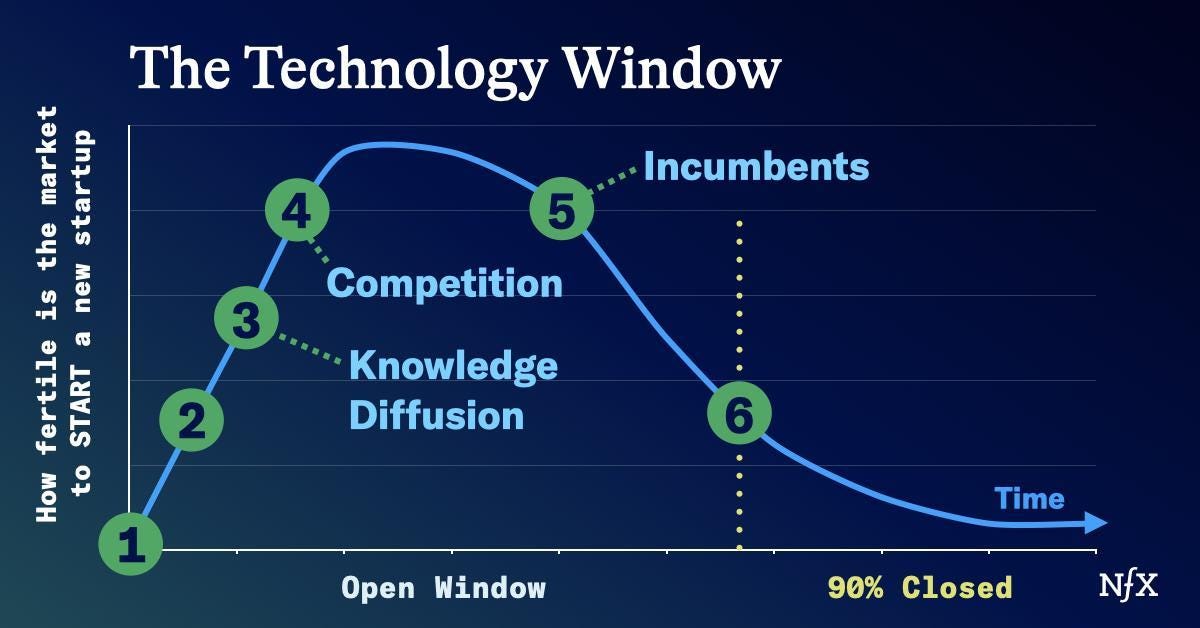

There’s a school of thought that mainstream consumer applications and services have their own cycles.

Each wave of Tech Value stacks typically started with hardware and software standards (open and closed), that defined the underlying hardware and software Infrastructure, provided by a growing set of specialized companies providing applications and services to businesses and consumers in the millions and billions.

These were typically the first three layers of the tech value stack (Box 1-3). They were then followed by sets of companies over time that then provided applications, content and services to consumers and businesses on top of the “stacks”.

I think everyone should read James Currier’s timely post titled: “Consumer is Back, and why it’s been so hard since 2014”.

“Evaluating companies has felt very different in the last twelve months from the prior 11 years because consumer is back. We’re seeing some really interesting consumer companies for the first time in forever. The creativity, the opportunity, the energy. It feels good!”

“No one talks about it, but consumer software startups had been “over” in the West for 11 years. At least if you’re trying to start and build a big company.”

“The reason it’s been so hard is simply that the technology window closed 90%, like it does for all technologies. We detailed technology windows in this essay, which is required reading to understand this essay.”

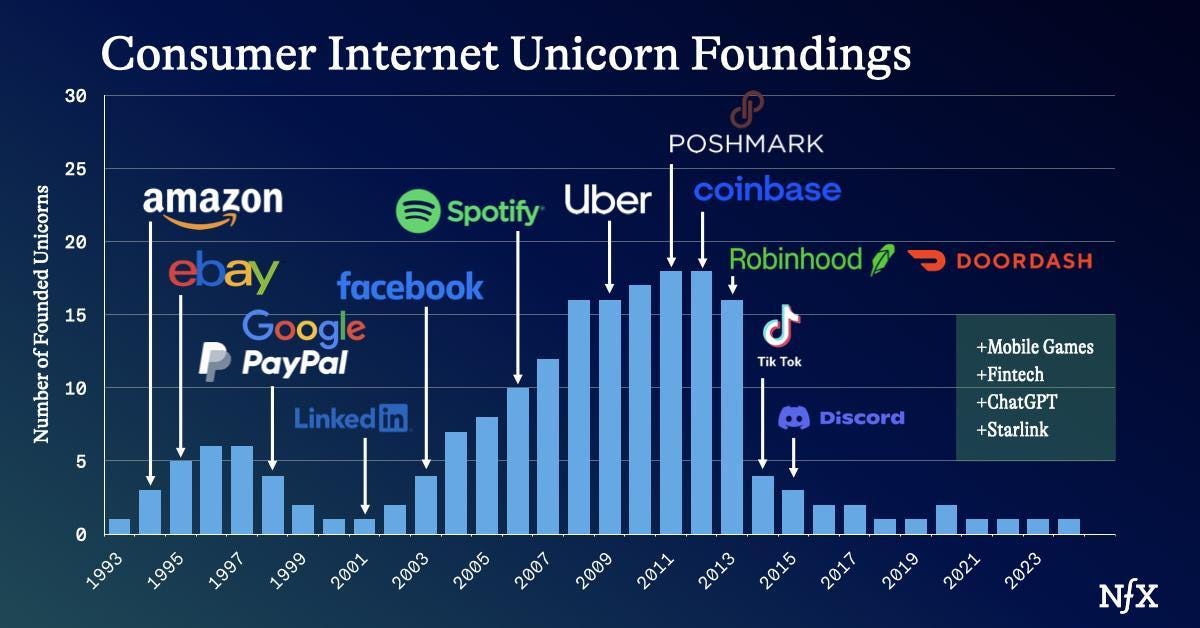

“If we look at the years when the unicorn consumer software companies were founded, you can see the classic curve of the technology window at work.”

He describes the waves of consumer internet companies in this framework:

“At first we got the “database reading” startups of Amazon and Google. The dip you see in the curve in 2000 was due to the macroeconomic business cycle. Then we got the “database writing” startups of LinkedIn, Facebook and Twitter. Then the mobile companies like Uber and Poshmark. Lastly, some laggards like Doordash and Robinhood which could have been started 5+ years earlier but the right teams didn’t get there until late in the consumer technology window, 2013.”

I particularly agree with another point James makes:

“You need to leverage AI. It’s a fantastic wedge that – still today – few startups other than OpenAI have used to discover new consumer behaviors, delights, needs, wants, and loves. It’s still sitting there for you to grab. The technology window for consumer AI is still early with all its openness and creativity.”

I do believe that the AI driven technologies of this AI Tech Wave have barely begun to be “consumerized”.

Most of the AI products to date are chatbots. And they’re still mostly focused towards developers than us mainstream consumers. This process is logical because we need the software and hardware building blocks in Boxes 3 to 5 in the AI tech stack above, before we can get to the countless consumer opportunities in Box 6.

That’s what has happened in prior tech waves. And this time, the particular evolution of AI through its developmental levels from chatbots to reasoning to agents on the way to AGI however defined, has to be invented and refined enough to build the mainstream consumer applications and services.

A common refrain since OpenAI’s ChatGPT took the world by AI Tech Wave storm in November 2022, is ‘where are all the ground-breaking mainstream AI apps and services?’

Ram CEO of Lumida Wealth had a great tweet:

“In the Dot Com era, we had genuine killer apps:”

- “Email (Hotmail com)”

- “E-Commerce (Amazon) - The Browser (Netscape Navigator)”

- “Online communities (AOL, Prodigy)”

- “Direct messaging (ICQ, AIM)”

- “Digital Music (Win Amp, Ipod, Napster)”

- “Chat (AOL) “

- “Internet Gaming (Quake) “

“Take stock of that... Any 3 of those would be remarkable.”

“The late 90s was truly an incredible time to be alive.“

“2024 is not shaping up in the same way.”

“GPT is great for drafting, summarizing and research... but these are not at 'killer app' level. I can do fine without GPT. It's not indispensable. I cannot rely on it for investment advice or decision making.”

We’re likely to see notable consumer focused companies sooner than later…

And the resulting “Staircase” AI Tech Value stack that develops will be similar to past stacks, and its started with hardware and software infrastructure like the underlying Chip and chip making companies - TSMC, ASML and Nvidia which are delivering the critical GPUs (Graphical Processing Units). (Box 1 in the chart).

The data centers that host the ‘Compute’ at scale (Box 2), are followed by the companies that provide the foundational large language models like ‘AI Native’ companies like OpenAI (Box 3). Those define the boxes leading to the middle of the “Staircase” stack.

These are then followed by additional layers in the stack that provide the massive amounts of Data and the constant processing and reprocessing of that data (Box 4). Followed then by software infrastructure and middleware (Box 5), to allow the building of applications and services at the top of the stack (Box 6).

In the case of the AI Tech Stack, unlike the earlier PC and Internet stacks, it’s uniquely turning out that the usage of the underlying large language models and data is providing critical loops of data that reinforce the learning in the underlying models.

This loop fundamentally changes the Tech value stack in the AI wave vs the earlier PC and Internet Waves.

Similar to Amazon 2001. We are just at the beginning stages of starting to build the value in these AI data models, and across the entire AI Tech Value stack layers.

Best Links of The Week🔮

“If there was any doubt before, this seals it: YouTube is in the TV business. According to Neal Mohan, YouTube’s CEO, TV screens have officially overtaken mobile as the “primary device for YouTube viewing in the U.S.” In other words, more people are watching YouTube on TV sets than any other device, at least here in the U.S. It is, as Mohan writes in his annual letter from the CEO, an indication that “YouTube is the new television”.” Source: The Hollywood Reporter

Elon Musk makes a bid to purchase OpenAi for $97.4b, quickly rejected by Sam Altman on X - WSJ

Apple (AAPL) will partner with Alibaba to develop new AI features for its users in China - Reuters

“Federal Reserve Chair Jerome Powell delivered a simple message to Congress to start two days of testimony on Tuesday: Because the economy is doing well, the Fed can take its time to decide when and whether to lower interest rates... Looking ahead, Powell said the Fed could keep rates on hold for much longer if inflation doesn’t continue to move down to its target and the economy remains solid. He said the Fed could cut rates if the labor market weakened unexpectedly or inflation made faster-than-expected progress declining to its 2% goal. Powell repeated his view that the neutral interest rate had moved up meaningfully from very low levels before the pandemic.” Source: WSJ

“Federal Reserve Chair Jerome Powell asserted Tuesday that the central bank will not develop its own digital currency as long as he is in charge. Ending several years of speculation whether the Fed would join some of its global counterparts, including China, in developing a formal [virtual] currency... Powell said during a Senate hearing that the project would not go forward.” Source: CNBC