Listen in podcast app and follow below for the podcast topic arc.

The problems facing NFL running back compensation

Risks of higher interest rates for longer

How Joel thinks about higher rates for investors

5% GST rebate for Real Estate developers

Recommendations and Links

Listen on Apple, Spotify, or Google Podcasts.

📈📊Market Update💵📉

Today was CPI day and the rest of the world is still struggling with historically tight employment.

Only and Canada and the US have anywhere close to sufficiently tight monetary policy to curb further acceleration in inflation and to top it all off, commodity prices are showing significant momentum.

The dot plot is telling us higher for longer… and that is bad for bonds and its bad for equities. So where does that leave us?

The only thing that seems to be holding up are gold and commodities.

Listen in today and check out some of the links below to see what were listening to and watching.

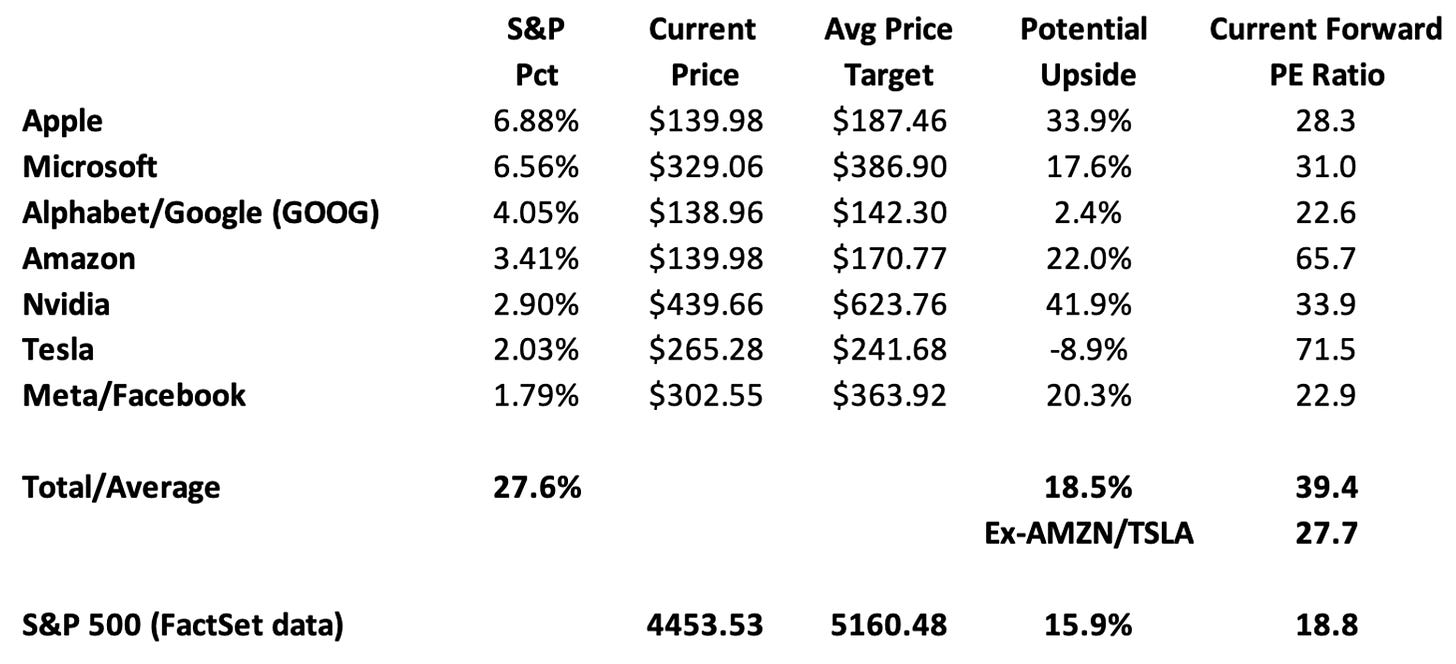

Valuation Chart from the pod:

Twitter links from the pod:

🎙Podcast & YouTube Recommendations🎙

Bill Gurley speaks at the All In Summit

Bob Elliott and Andy Constan on the next 5 months in the market:

Ben Thompson at Sharp Tech talks everything Media:

🔮Best Links of The Week🔮

Alberta eyes more than half of CPPs assets! - Globe and Mail

High interest savings account or invest in stocks? - Globe and Mail

Federal Reserve officials are set to hold interest rates steady at their meeting Wednesday >>Officials debate rate hikes, shifting from inflation concerns to avoiding a sharp slowdown, amid signs of easing inflation and labor market cooling - WSJ

High borrowing costs and the shortage of properties for sale have slowed home buying by Wall Street’s rental giants >> Higher rates, expensive financing, and fierce competition hinder major landlords from buying homes, despite the rental market boom. - WSJ

Apollo’s sees ‘Unprecedented Returns’ From Private Debt >>Amid traditional banks' retreat due to rate hikes, private credit providers are poised for unprecedented returns in upcoming years as primary lenders in buyouts. - Bloomberg

Disclaimer:

Investing in equities, fixed-income instruments and/or alternative asset classes involves substantial risk of loss. Any action you may take as a result of the information presented on this website, blog or in any Reformed Millennials Podcast (a “podcast”) is your own responsibility. By opening this page and/or listening to a podcast, you accept and agree to the terms of this full legal disclaimer. The information on this website, blog and in any podcast is presented as a general educational, informational and entertainment resource only. While Joel Shackleton is registered to provide investment advice as an Advising Representative this website, blog and any podcast does not provide, and should not be construed as providing, individualized investment, tax or insurance advice, nor as containing any recommendation to buy or sell any specific securities or otherwise make any other form of investment, or take any tax or insurance decision. Nothing contained on this website, blog or in any podcast should be construed or interpreted by you to mean that an investment in any securities presented or discussed would be suitable for you in your particular circumstances. Joel Shackleton specifically disclaim that any viewer of this website, blog or any podcast should rely in any way on any of their contents as investment, tax or insurance advice or as an investment, insurance or tax recommendation. Viewers are encouraged to consult with their individual investment advisor and other financial professionals prior to taking any potential investment actions or making any insurance or tax decisions. The views and opinions expressed herein are the personal views and opinions of Joel Shackleton and any other specific contributor to the blog or podcast only and do not necessarily reflect the views or opinions of their Firm or any of its other registered individuals or employees in partnership with Joel and his guests. Joel Shackleton disclaims any obligation to update any of the information set out on this website or any blog or podcast going-forward.

Share this post