Listen in podcast app

Big Sports Weekend

Market Update

Big Tech Earnings (Meta, Amazon, Microsoft, Google)

The Canadian Housing Crisis

Recommendations and Predictions

Listen on Apple, Spotify, or Google Podcasts.

📈📊Market Update💵📉

BUY WHAT YOU KNOW!

Recap of Big Tech Earnings This Week:

What a crazy week for earnings.

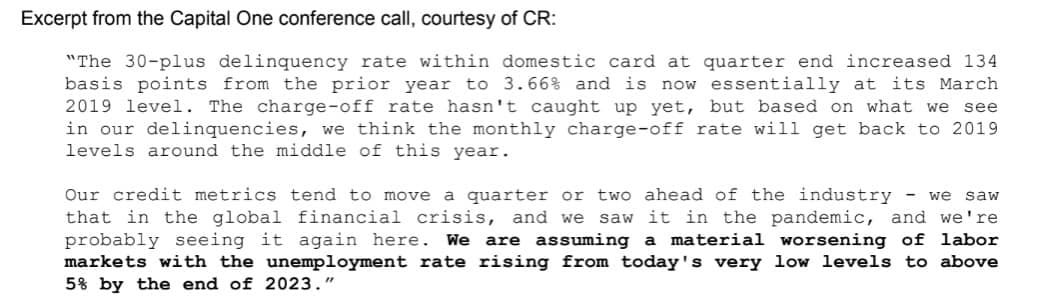

The consumer remains resilient but credit card data is showing a slowdown in consumption for the American consumer. This is echoed by Amazon's 0% sales growth YoY and this excerpt from the Capital One confrence call:

Meta’s family of apps continues to show signs of strength in the face of ATT, ticktock, and a slowing consumer/ad spend.

Highly recommend reading Eric Seufert’s twitter thread on revenue and ATT here.

With that said, the return of big tech dominance is mind-numbing. Consider the below:

Apple and Microsoft have accounted for nearly 50% of the S&P500 move YTD.

Add the rest of FAANG and it has accounted for a whopping 94% of the S&P500 return YTD.

With Amazon having reported yesterday after the close with beats, FAANG outperformance could account for the entire S&P500 gain when the US opens today.

Microsoft accounted for 140% of the NDX move on Thursday. The equal-weighted Nasdaq was actually down.

The question around markets has become - “Is this a flight to safety in America just for big tech? Or is there a flight out of US equities ex-big tech into Europe and emerging markets?

Or both?

Chart below is from: Jim Bianco

And the story about the chart from Jim’s Tweet thread:

The contribution to the year-to-date return of the S&P 500.

Through yesterday (April 26), the year-to-date return S&P 500 (black line) was 5.13%

The top eight FAANG+ M N T (names on the chart) contributed 5.57% to the overall 5.13% of the S&P 500

The "other 492" contributed a -0.44% return to the S&P 500; the "other 492" has collectively dragged the S&P 500 lower. So, what is the message from the stock market?

The economy is good as the stock market is up more than 5% after four months.

The economy is suspect as collectively, "other 492" stocks are dragging the S&P 500 lower again this year like last year.

💸Reformed Millennials - Post of The Week

The main conversation I’m having with clients right now is whether or not housing prices have bottomed…

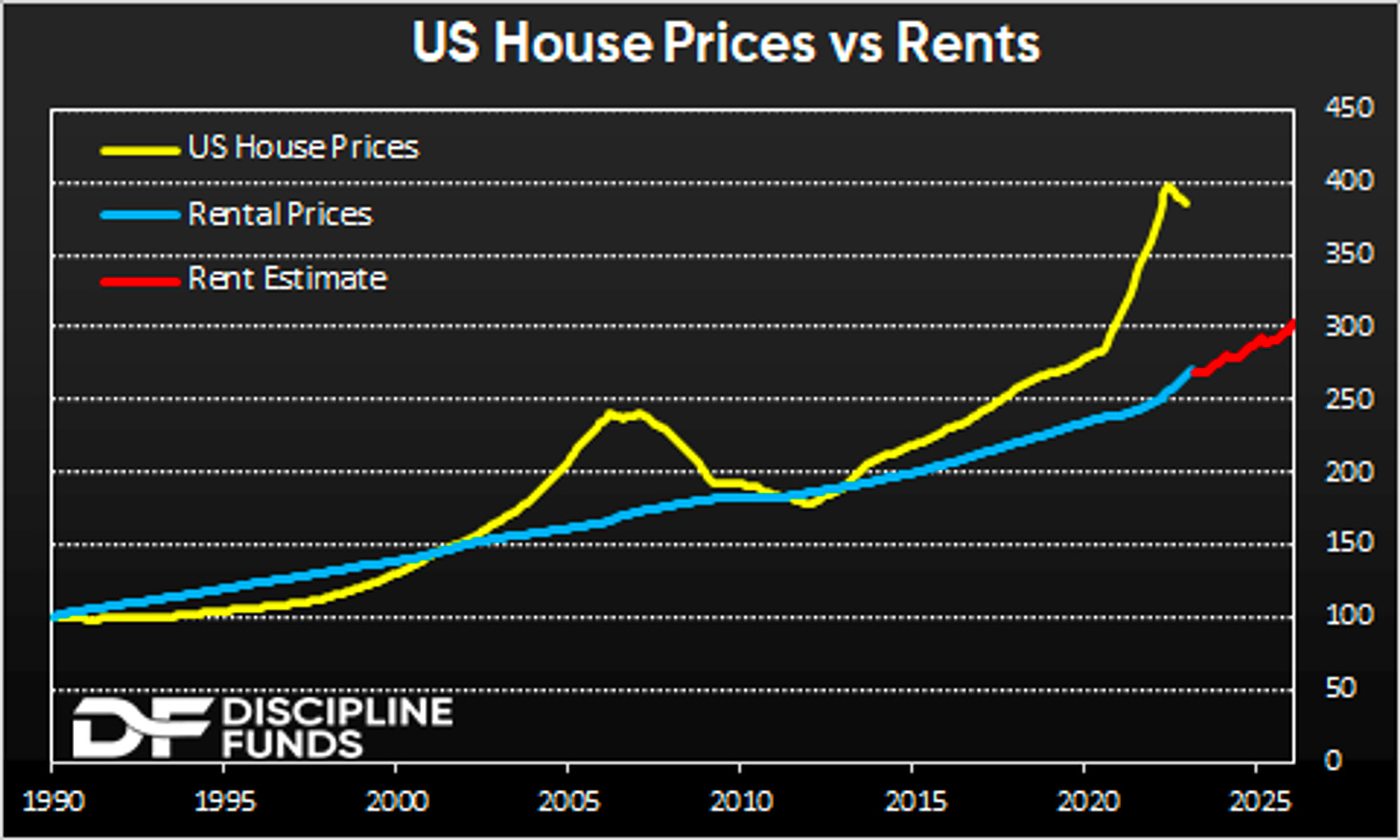

Obviously this is impossible to know. But I do think putting into perspective the rise in the price of a home and the subsequent rise in the cost of financing helps people think about what could happen to rents and the price of housing.

My thoughts regarding the Discipline funds chart above: if rates stay higher for much longer then...that puts downward pressure on the economy AND house prices.

Further, disposable income hasn't nearly kept pace with rent increases so landlords don't even have the pricing power to push rents up at the current rate of change.

This doesn't mean house prices have to crash. I don't think they will. But I do think the much more probable outcome here is a multi-year muddle through where house prices continue to fall modestly and rents grow modestly as the two converge in the coming years.

Wild card continues to be supply… prices bouncing hard up here recently on terrible supply.

And is why I don't think prices will crash. But supply shortage is also running into a demand shortage which is only going to get worse as lending standards continue to tighten.

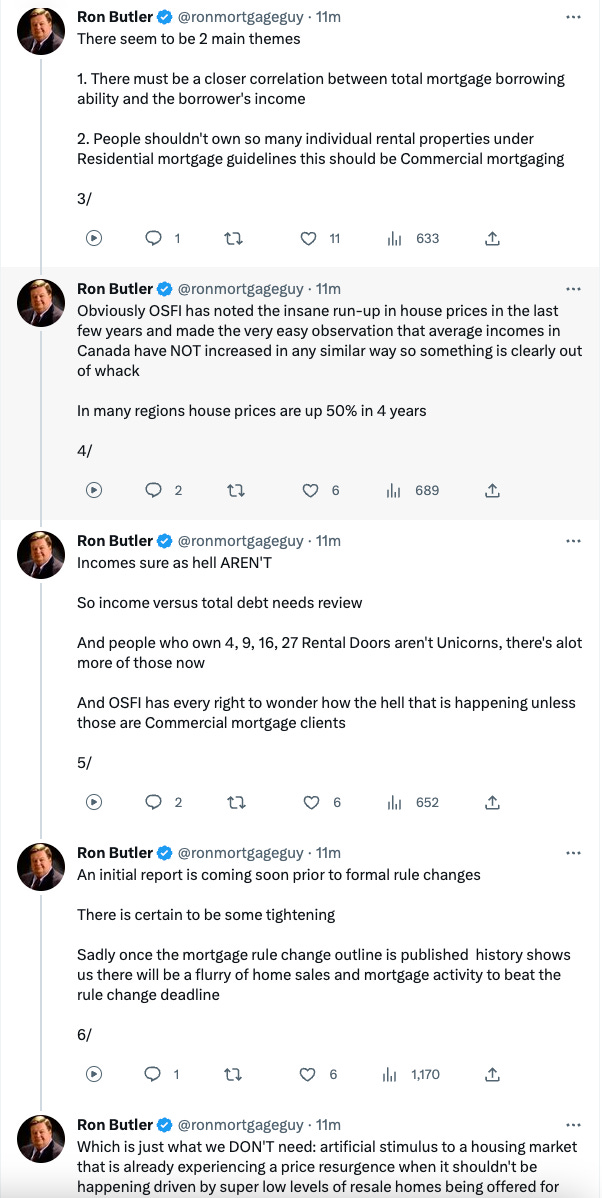

Canadian Tweet of The Week🇨🇦

https://twitter.com/ronmortgageguy/status/1653022875710902275?s=20

🎙Podcast & YouTube Recommendations🎙

Elon’s full interview with Bill where he talks about Twitter, AI, Water and Electric Vehicles.

“When copies are free, you need to sell things that cannot be copied. Well, what can’t be copied? Trust, for instance.” ~@kevin2kelly

🔮Best Links of The Week🔮

Books might be a colossal waste of productivity because we absorb very little of what we read. Is it time to design a medium that helps us understand ideas more effectively? This article explores that question. - Source: Andy Matuschak

RBC Consumer Spending Tracker Report - Source: RBC Special Reports

Investing’s Big Blind Spot - Source: Sapient Capital

"Elon Musk expects SpaceX to spend about $2 billion on its Starship rocket development this year, as the company pushes to build on its first launch earlier this month. “My expectation for the next flight would be to reach orbit,” Musk said, speaking during a discussion on Twitter Spaces on Saturday... Musk said the company does “not anticipate needing to raise funding” to further bolster the Starship program and its other ventures... He put the probability of reaching orbit with a Starship flight this year at “probably” 80%, but espoused that he thinks there is a “100% chance of reaching orbit within 12 months"." -Source: CNBC

ChatGPT is going to change education, not destroy it - The narrative around cheating students doesn’t tell the whole story. Meet the teachers who think generative AI could actually make learning better. - Source: MIT Technology Review

👉 For specific investment questions or advice contact Joel @ Gold Investment Management.

Investing in equities, fixed-income instruments and/or alternative asset classes involves substantial risk of loss. Any action you may take as a result of the information presented on this website, blog or in any Reformed Millennials Podcast (a “podcast”) is your own responsibility. By opening this page and/or listening to a podcast, you accept and agree to the terms of this full legal disclaimer. The information on this website, blog and in any podcast is presented as a general educational, informational and entertainment resource only. While Joel Shackleton is registered to provide investment advice as an Advising Representative with Gold Investment Management Ltd. (“GIM”), a firm registered as a portfolio manager and located in Edmonton, Alberta, this website, blog and any podcast does not provide, and should not be construed as providing, individualized investment, tax or insurance advice, nor as containing any recommendation to buy or sell any specific securities or otherwise make any other form of investment, or take any tax or insurance decision. Nothing contained on this website, blog or in any podcast should be construed or interpreted by you to mean that an investment in any securities presented or discussed would be suitable for you in your particular circumstances. Joel Shackleton and

GIM specifically disclaim that any viewer of this website, blog or any podcast should rely in any way on any of their contents as investment, tax or insurance advice or as an investment, insurance or tax recommendation. Viewers are encouraged to consult with their individual investment advisor and other financial professionals prior to taking any potential investment actions or making any insurance or tax decisions. The views and opinions expressed herein are the personal views and opinions of Joel Shackleton and any other specific contributor to the blog or podcast only and do not necessarily reflect the views or opinions of GIM or any of its other registered individuals or employees. Joel Shackleton and GIM disclaim any obligation to update any of the information set out on this website or any blog or podcast going-forward.

In his capacity as an investment adviser with GIM, Joel Shackleton (or other representatives of that firm) may be buying or selling for clients of the firm securities presented on this webpage, in a blog or in a podcast concurrently, before or after any information presented therein, and may be acting for clients in a manner contrary to the information presented therein.

Joel Shackleton and his co-host, Cam Pitchers, or members of their respective immediate households or families, own securities of the following companies mentioned therein: {MSFT, GOOG, META, AMZN}. Joel Shackleton and Cam Pitchers personally are, or members of their respective immediate households or families are, paid by the following companies mentioned therein: {none}. Joel Shackleton and Cam Pitchers personally have, or members of their respective immediate households or families have, a financial relationship with the following companies mentioned therein: {none}.

GIM, or accounts managed or controlled by the firm, own securities of the following companies mentioned in this article: {MSFT, GOOG, META, AMZN}. GIM, or accounts managed or controlled by the firm, are paid by the following companies mentioned in this article: {none}. GIM, or accounts managed or controlled by the firm, have a financial relationship with the following companies mentioned in this article: {none}.